KSKEV Corpo Presentation

Transcript of KSKEV Corpo Presentation

-

8/8/2019 KSKEV Corpo Presentation

1/21

Corporate PresentationMay 2010

-

8/8/2019 KSKEV Corpo Presentation

2/21

Corporate Presentation, 2010

Disclaimer

The information and opinions contained in this presentation are current, if not stated otherwise, as of the date of this presentation. We undertake

no obligation to update or revise any information or the opinions expressed in this presentation as a result of new information, future events or

otherwise.

Certain statements made in this presentation may not be based on historical information or facts and may be forward looking

statements, including those relating to our general business plans, planned projects and strategy, our future financial condition and growth

prospects, future developments in our industry and our competitive and regulatory environment. Actual results may differ materially from these

forward-looking statements due to a number of factors, including future changes or developments in our business, our competitive environment

and political, economic, legal and social conditions.

This presentation does not constitute an offer or invitation to purchase or subscribe for any securities in any jurisdiction, including the United

States. No part of it should form the basis of or be relied upon in connection with any investment decision or any contract or commitment to

purchase or subscribe for any securities.

This presentation is confidential and may not be copied or disseminated, in whole or in part, and in any manner. No person is authorized to give

any information or to make any representation not contained in or inconsistent with this presentation and, if given or made, such information or

representation must not be relied upon as having been authorized by us.

Corporate Presentation, 2010 1

-

8/8/2019 KSKEV Corpo Presentation

3/21

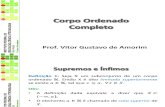

Corporate Presentation, 2010

Introduction

KSK Power Ventur plc

KSK Energy Ventures

Limited

KSK Energy

Company

KSK

Renewable

KSK Energy Limited, Mauritius

51.32% 100 % 100 %

Thermal PowerPlants

Operating & Near

Completion 862

MW

Construction plants

- 3730 MW

Planned -6345 MW(where fuel tied up)

Lignite MineOperating

Multiple new

mineral

collaborations

Wind Energy Solar

Others

KSK Power Ventur Plc is the London Stock Exchange

listed parent holding company engaged in the business

across the energy value chain

KSK Energy Ventures Limited, the Indian listedsubsidiary that develops, implements, owns and

manages multiple power generation projects in India

KSK is one of the few business groups in India with vital

fuel security through collaboration on coal resources

with long term low cost access to dedicated coal

blocks

Attractive business model with high margin power plant

portfolio with mix of long term direct off take by Large

industrial consumers and short term surplus sale to

local utilities at attractive prices

Pioneering work in dedicated / Group captive power

plant business in India. Proven execution track record

across multiple states in India

Corporate Presentation, 2010 2

-

8/8/2019 KSKEV Corpo Presentation

4/21

Corporate Presentation, 2010

Background

Promoted by K.A.Sastry and S. Kishore, first generation entrepreneurs with extensive financial and energy sector

consulting experience prior to the business setup

Padma Bhushan Sri T.L.Sankar, the distinguished Energy expert is the Non Executive Chairman. Highly experienced

management and operating team and power plant setup experience across multiple states in India

Valued relationships with Industrial Consumers and Government Utilities and Mining Corporations in India

Project Finance driven individual power plant SPVs. Established credibility with major Indian Project Lending institutions

and hence access to vital debt for project execution

Impressive historical revenue growth, strong opportunity pipeline and adequately capitalized on the equity for the next

level of growth

BT ranking 78th amongst Indias most valuable Private Sector Companies.

3

-

8/8/2019 KSKEV Corpo Presentation

5/21Corporate Presentation, 2010

Indian Power Industry Overview

Power sector has historically witnessed energy shortages, which

have only increased over the years

Power Supply Position (Energy in MU) Merchant market - Pricing Trends

690,587

631,757591,373

559,264545,983

522,537

483,350 497,890

519,398548,115

578,819

624,495

2001-02 2002-03 2003-04 2004-05 2005-06 2006-07

Requirement Availability

Nascent Short term power market (c 4 % of total

generation) with high volatility

Capacity Addition History for each Five Year Plan

72%

96%

64% 64%49%

85%

52%54%

48%

85%

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

I II III IV V VI VII VIII IX X

0%

20%

40%

60%

80%

100%

120%

Target (MW) Achievement (MW) %

Failure to meet capacity addition targets has exacerbated the

demand / supply imbalance

Source: CEA

4

Required Capacity Addition (12th Plan) (2012 2017) (1)

11th Plan working group has recommended capacity

addition of 82, 200 MW for the 12 th Plan

Capacity

AdditionInstalled

Peak

Demand

Electricity

GenerationGDP

82,200291,700224,6001,4709%

10%

8%

Growth (%)

1,525

1,415

Required

(BU)

232,300

215,700

(MW)

92,800302,300

70,800280,300

Required

(MW)

Capacity

(MW)

Capacity

AdditionInstalled

Peak

Demand

Electricity

GenerationGDP

82,200291,700224,6001,4709%

10%

8%

Growth (%)

1,525

1,415

Required

(BU)

232,300

215,700

(MW)

92,800302,300

70,800280,300

Required

(MW)

Capacity

(MW)

0

100

200

300

400

500

600

700

800

900

0.0

5.0

10.0

15.0

20.0

25.0

30.0

Jan-0

9

Fe

b-0

9

Mar-09

Apr-09

May-0

9

Jun-0

9

Jul-09

Aug-0

9

Sep-0

9

Oct-09

Nov-0

9

Dec-0

9

Jan-1

0

Fe

b-1

0

Mar-10

MnkWh

Cents/kWh

Volume Tariff

-

8/8/2019 KSKEV Corpo Presentation

6/21Corporate Presentation, 2010

540 MW Warora project initiated

Collaborative MOUs with govt mineralcorporations

GMDC CSA for 1800 MW power plant

KSK Power Listed on LSE AIM $ 60 mn raised

KEFIPL Joint Venture

135 MW VS Lignite enabled Gurha block 43 MW Sitapuram initiated

58 MW Sai Regency initiated

17.4 MW Coromandel Electric commences

43 MW Arasmeta MoU with LafargeIndia

Full tie-up of Small is Beautiful fund

Journey/ Milestone

20 MW Kasargod Plant

commences

20 MW RVK plant

commences

KSK Plc moves to main market oLSE

VSLP Commences powergeneration

More than 10+ GW of Portfolio

725 MW Secures Hydro Projects of PIPDIC Coal supply Agreement additional 1800 MW

GE Picks strategic stake in Sayi

Sitapuramand Sai Regency Operational

10.9 MW MMS Plant

commences

IPO of KSK Energy $ 300mn raised Chhattisgarh Plant- 1800 MW

Divested earlier assets Coal supply Agreement with GIDC

Chhattisgarh power plant up scaled to3600 MW

Additional Fund raise at KSK plc $ 60 mnas well as KSK Energy - $ 115 mn

VS Lignite mine commences

Corporate Presentation, 2010 5

-

8/8/2019 KSKEV Corpo Presentation

7/21Corporate Presentation, 2010

Project Portfolio

Plant Capacity (MW) Configuration Type Fuel Location Off-Takers Remarks/ Status

A. Operational

Arasmeta 43 1 X 43 Thermal Coal Chhattisgarh Captive COD - Nov '06

Sai Regency 58 1 X 58 Thermal Natural Gas Tamil Nadu Group Captive COD - Mar '07Sitapuram 43 1 X 43 Thermal Coal Andhra Pradesh Captive COD - Feb '08

VS Lignite 135 1 X 135 Thermal Lignite Rajasthan Group Captive Started operation in Mar'10

279

B. Near Completion

Wardha Warora 540 4 X 135 Thermal Coal Maharashtra Group Captive

Unit I: Synchronized in Apr'10. All subsequent

units with intervals of 3 months, last Unit in

Q4FY11

Arasmeta Exp 43 1 X 43 Thermal Coal Chhattisgarh Captive Expected COD: July '10

583

C. Under Construction

KSK Mahanadi 3,600 6 X 600 Thermal Coal Chhattisgarh

Expected COD: Unit I in Q1FY13 and all

subsequent units with intervals of 4months,

with last Unit in Q3FY14

KSK Dibbin 130 Hydro N.A. Arunachal Pradesh Expected COD: 2013

3,730

D. Under Planning

JR Power 1,800 3 X 600 Thermal Coal Orissa Expected COD: 2015

KSK Narmada 1,800 3 X 600 Thermal Coal M.P. Expected COD: 2015

KSK Naini 1,800 3 X 600 Thermal Coal Orissa Expected COD: 2016Kamang HEP 600 Hydro N.A. Arunachal Pradesh Expected COD: 2016

Kamang Basin HEP 345 Hydro N.A. Arunachal Pradesh Expected COD: 2016

6,345

Grand Total (A+B+C+D) 10,937

Corporate Presentation, 2010 6

-

8/8/2019 KSKEV Corpo Presentation

8/21Corporate Presentation, 2010

Projects Overview

Sai Regency (58MW)

Diversification by Geography Capacity Addition

Wardha Warora(540MW)

Sitapuram (43 MW)

Project Status

OperationalUnder Construction

Under Development

Planning

VS Lignite(135MW)

Dibbin HEP (130 MW)

Kameng Basin (345 MW)

Kameng Dam (600 MW)

Wardha Naini (1,800 MW)

JR Power (1,800 MW)

Wardha Chhattisgarh(3,600MW)

Arasmeta Exp. (43MW)

Arasmeta (43MW)

7

1,800

3,000

1,545 6,345

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2014 2015 2016 Cum

MW

Further Capacity Addition Plans

144 135

583

1,930

1,800 4,592

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

FY09 FY10 FY11 FY12 FY13 FY14 Cum

MW

Total Power plant portfolio of over 10 GW

KSK Narmada (1,800 MW)

-

8/8/2019 KSKEV Corpo Presentation

9/21Corporate Presentation, 2010

Project Update

Arasmeta (Chattisgarh) - 43 MW Coal US$ 36 Mn

Voting Equity: 51% , Economic Interest: 100%

In operation since 2006 D:E 70:30

2009-10 PLF: 84.6 % Avg Tariff: Rs. 3.33/ kWh ( 7.4 c / kWh)Power Purchases by Lafarge India and surplus to local utility

Sai Regency Power (Tamil Nadu) - 58 MW Natural Gas US$ 49 Mn

Voting Equity: 74% , Economic Interest: 100%

In operation since 2007 D:E 75:25

2009-10 PLF: 70.3 % Avg Tariff: Rs. 3.93/ kWh ( 8.7c / kWh)Power Purchases by multiple Industrial consumers in Tamil Nadu and surplus to local utility

Sitapuram (Andhra Pradesh) 43 MW Coal US$ 36 Mn

Voting Equity: 49% , Economic Interest: 100%

In operation since 2007 D:E 70:30

2009-10 PLF: 85.7% Avg Tariff: Rs. 4.46/ kWh ( 9.9 c / kWh)Power Purchases by Zuari Cements and surplus to local utility

VS Lignite (Rajasthan) 135 MW Lignite US$ 155 MnVoting Equity: 74% , Economic Interest: 100%

Commenced generation by end March 2010 D:E 75:25

Power Purchases by multiple Industrial consumers in Rajasthan and surplus to local utility

8

* USD / INR conversions at Rs 45 per USD

-

8/8/2019 KSKEV Corpo Presentation

10/21Corporate Presentation, 2010

Project Update

Wardha Warora, (Maharashtra) - 540 MW Coal US$ 535 Mn

Voting Equity: 74% , Economic Interest: 100%

It consists of 4 Units, each of 135 MW. D:E 80:20

The Unit I completion in May 2010.Unit II, III & IV expected with each at a quarterly interval from the other

KSK Mahanadi, Akaltara (Chattisgarh) - 3600 MW Coal US$ 3.59 Bn

Voting Equity: 100% , Economic Interest: 100%

It consists of 6 Units, each of 600 MW. D:E 75:25

EPC contract has been awarded to SEPCO

Active Construction at site.

Arasmeta Expansion, (Chattisgarh) - 43 MW Coal US$ 49 Mn

Voting Equity: 51% , Economic Interest: 100%

It consists of 1 Unit of 43 MW. D:E 80:20

Execution by the Company through multiple Packages

Active Construction at site.

KSK Dibbin (Arunachal Pradesh) - 130 MW Hydro US$ 154 Mn

Voting Equity: 100% , Economic Interest: 100%

MOU signed with Government in 2007 D:E 75:25

Techno Economic clearance obtained in 2009

Total Active Power project Investments of over USD 4.6 billion*

9

* USD / INR conversions at Rs 45 per USD

-

8/8/2019 KSKEV Corpo Presentation

11/21Corporate Presentation, 2010

KSKs current effort on additional blocks, linkages and agreements underway

Fuel Resources Security of Supply

Gurha

Morga-I (MPSMC)

Naini (GMDC)

Lignite Block

operational

MOUs

executed, Alloca

tion received

StatusFuel Block Tie up

Fuel Supply

Agreement

completed

Morga I

Coal Block

Lunsara

Lignite Block

Morga II (GMDC)

Naini (PIPDIC)

Gera Pelma III (GIDC)

Power Plant

VS Lignite

135 MW

KSK Mahanadi

3600 MW

JR Power

1800 MW

KSK Narmada

1800 MW

Naini 1800 MW

Gurha(E),

Lignite Block

Morga II

Coal Block

Naini Coal Block

Naini Coal Block

Gera Pelma - III

Coal Block

KSK Headquarters

Hyderabad

Fuel Supply

Agreement

completed

10

-

8/8/2019 KSKEV Corpo Presentation

12/21Corporate Presentation, 2010

Captive Mine Block Development Experience

Land

Acquisition

Completed

July 05 July 06 July 07 July 08

May08

Block

Allocated

May05

NOC from

PCB

June06

ML Executed

Aug08

Mine Plan

Approval

July06

Environment

Clearance

Mar07

DGMS

Permission for

mine opening

Oct08

Mining

Commenced

Nov08

Lignite Seam

Exposed

Apr09

ML

Application

Dec05

Mine Plan

Submission

Dec05

Public

Hearing

Fe

b06

Application

for Land Acq

Mar06

11

-

8/8/2019 KSKEV Corpo Presentation

13/21

Corporate Presentation, 2010

Non Executive Chairman

Mr. Kishore co-founded KSK along with Mr.

Sastry and heads its business development

and capital formation. Earlier Mr. Kishore was

a financial advisor & consultant for majordomestic as well as international businesses

and has advised multiple energy companies/

utilities/ market entrants since early nineties.

Mr. Dlouhy graduated with a Bachelor and

Master degrees in Mathematical Economics

and Econometrics from the Prague School of

Economics and studied Management at

Catholic University of Louvain, Belgium. Mr.

Dlouhyserved as Minister of Industry and

Trade of the Czech Republic, responsible for

the policies in the areas of Fuels.

Executive Directors

Board of Directors KSK Power Ventur plc

Independent Non-executive Directors

Padma Bhushan

Mr. T.L. Sankar,

Non-executive Chairman

Mr. S. KishoreExecutive Director

Mr. K.A. Sastry

Executive Director

Mr. Vladimir Dlouhy

Non-Executive Director

Mr. S.R. IyerNon-Executive Director

Renowned in India as an energy expert with

more than four decades of experience in the

energy sector. Served various distinguished

positions

Energy Secretary to the Government of

Andhra Pradesh Secretary, Fuel Policy Committee

Principal Secretary of the Working Group

on Energy Policy

Member of the Advisory Board on Energy

Government of India,

Member, Integrated Energy Policy

Committee.

Chairman of the Andhra Pradesh State

Electricity Board

United Nations Adviser on Energy issuesto the governments of Sri Lanka.

Mr. Sastry is one of the founders of KSK and

heads its execution and operations areas, as

well as having responsibility for the financial

accounts and records for the group. Earlier

Mr. Sastry was associated with Mr. Kishore

on the advisory & consultancy assignments

by their firm K&S.

Mr Iyer retired as Managing Director of the

State Bank of India in 2001. Since then he has

served on various banking industry working

groups in India and currently associated with

other companies in Non executive capacity

Mr Vladimir is a distinguished Economist with

over three decades of experience in

industrial affairs and served as Deputy

prime minister of Czechoslovak government

and federal minister of economy. He

currently serves as International Advisor

Goldman Sachs and ABB

12

-

8/8/2019 KSKEV Corpo Presentation

14/21

Corporate Presentation, 2010

Additional Board Members KSK Energy Ventures Limited

Corporate Presentation

Anil Kumar Kutty, Director

M.Sc (Physics)

Formerly Indian Administrative Service

Previous Experience:

Joint Secretary, Power , Government of India

Chairman and Managing Director, AP TRANSCO

K.Bapi Raju, Whole time Director

B.Tech

Previous Experience:

Marketing Director, Kirtilal Kalidas

Director, Micro GIS Technology

Girish Kulkarni, Director

B. Tech IIT Mumbai. India

M.B.A, IIM Ahmedabad, India

Previous Experience:

Head, Equity sales of ICICI Securities Managing Director, TDA Capital partners

Abhay Nalawade, Director

MBA, University of Pune

Management progaram at Harvard Busines School

Previous Experience: CEO, Thermax

30+ years of experience in Power engineering

Involved in power plant equipment and cogneration business

Currently heads Eco Axis system

20+ yrs of experience in Indian Corporate sector

Responsible for Corporate Affairs of the Group

Extensive experience in areas of energy security, policy formulation, business

collaboration

20+ yrs of experience in Indian capital Markets

Head of Equity Sales of ICICI Securities ( JV between ICICI and JP Morgan)

Involved more than 30 IPOs and multiple M&A transactions in India

31+ yrs of experience in power sector, Banking and Administration India.

Involved with Indias power sector reforms and first CMD of AP Transco

Significant sectoral experience

Henry Klein, Director

MBA, Columbia University, New York

Masters in Science, Cape Town, South Africa

20+ yrs of international Investment Banking experience.

Co-founded TDA Capital partners in 1996 with investments in central

Europe, Israel and India

Managing Director of Principal investments Division at Lehman Brothers

Tanmay Das, Director

CFA

MBA, XIM, Bhubaneswar, India

Bachelors in Engineering, India Previous Experience: Projects Division, IFCI

15+ yrs of in depth Power sector experience in India

Overseen Finance, investments, Capital structuring, Project finance and Asset

Management functions

13

-

8/8/2019 KSKEV Corpo Presentation

15/21

Corporate Presentation, 2010

Partners in our Growth

14

http://images.google.co.in/imgres?imgurl=http://www.antya.com/upload/8/BKT-Logo.gif&imgrefurl=http://www.antya.com/detail/Balkrishna-Tyres/72351&usg=__EPRhf0YvvQchKDi5trR4aGupdc4=&h=71&w=117&sz=5&hl=en&start=8&um=1&itbs=1&tbnid=UdR2r4mmI7SMaM:&tbnh=53&tbnw=88&prev=/images?q=balkrishna+tyres&um=1&hl=en&rls=com.microsoft:en-US&tbs=isch:1http://images.google.co.in/imgres?imgurl=http://www.chennai.swiftclub.org/jktyre.jpg&imgrefurl=http://www.chennai.swiftclub.org/&usg=__8dSWCSZFw57z9S2OqWUjPACuJIc=&h=102&w=326&sz=22&hl=en&start=7&um=1&itbs=1&tbnid=xYaC0Bx666CxjM:&tbnh=37&tbnw=118&prev=/images?q=jk+tyre+logo&um=1&hl=en&rls=com.microsoft:en-US&tbs=isch:1http://images.google.co.in/imgres?imgurl=http://www.careers-india.com/wp-content/uploads/2009/10/IDBI-Logo.gif&imgrefurl=http://www.careers-india.com/2009/10/07/idbi-bank-recruitment-interview-schedule-idbi-bank-online-call-letters-for-interviews-idbi-bank-recruitment-results/&usg=__UWUN61tCVFAGqSGyF5kBzpbp1S8=&h=127&w=236&sz=5&hl=en&start=4&um=1&itbs=1&tbnid=DiJzVEFxDqozrM:&tbnh=59&tbnw=109&prev=/images?q=IDBI&um=1&hl=en&rls=com.microsoft:en-US&tbs=isch:1http://images.google.co.in/imgres?imgurl=http://www.freshnews.in/wp-content/uploads/2008/12/sbi-300x300.png&imgrefurl=http://www.freshnews.in/sbi-bob-boi-slash-lending-rates-106498&usg=__VdZk0qTg-1hZ4wgJf0yl1TZ2J4E=&h=300&w=300&sz=14&hl=en&start=6&um=1&itbs=1&tbnid=CI45DNh5KxrD4M:&tbnh=116&tbnw=116&prev=/images?q=SBI&um=1&hl=en&sa=N&rls=com.microsoft:en-US&tbs=isch:1http://images.google.co.in/imgres?imgurl=http://www.sustainability.com/commonfiles/images/USS_logo.jpg&imgrefurl=http://www.pharmafutures.org/3/peopleandpartners.asp?id=63&usg=__m8ek6W15iICen6_3l6iLAhdM1Uo=&h=180&w=180&sz=33&hl=en&start=2&sig2=9RFPqeD7EByJmkOIrZ10dg&um=1&itbs=1&tbnid=JNS-17gePbIerM:&tbnh=101&tbnw=101&prev=/images?q=universities+superannuation+scheme&um=1&hl=en&sa=N&rls=com.microsoft:en-US&tbs=isch:1&ei=PSfZS73QG47m7AOt8YVUhttp://images.google.co.in/imgres?imgurl=http://oldskoolmark.files.wordpress.com/2008/08/ge-logo.jpg&imgrefurl=http://oldskoolmark.wordpress.com/2008/08/&usg=__69IPVN8AVQwRttIHn2jXkcjctXc=&h=473&w=474&sz=76&hl=en&start=1&sig2=xFIwRHSijqNInMyU72iELg&um=1&itbs=1&tbnid=stZAwipW7cw0jM:&tbnh=129&tbnw=129&prev=/images?q=ge&um=1&hl=en&sa=N&rls=com.microsoft:en-US&tbs=isch:1&ei=ZSXZS9mLFIrU7AOdyIxQhttp://2.bp.blogspot.com/_BOlBv4dcTyE/R8TGuOTHQmI/AAAAAAAAAu4/uJyktRb32qQ/s200/PowerFinance.JPGhttp://www.bankofbaroda.com/bob100/http://images.google.co.in/imgres?imgurl=http://inflatablesuk.co.uk/blog/wp-content/uploads/2008/12/alc-logo.jpg&imgrefurl=http://inflatablesuk.co.uk/blog/69&usg=__s-yWLq6t3uaIHnLo_ogSDF1xuKI=&h=258&w=900&sz=52&hl=en&start=4&um=1&itbs=1&tbnid=khfvDmfvm6CAVM:&tbnh=42&tbnw=146&prev=/images?q=air+liquide&um=1&hl=en&tbs=isch:1http://images.google.co.in/imgres?imgurl=http://www.topnews.in/files/mahindra_logo_0.jpg&imgrefurl=http://www.topnews.in/mahindra-mahindra-pump-rs-1500-crore-more-chakan-facility-229123&usg=__WVLAD-jc0RyhIt57i-6rMEAtiQk=&h=150&w=150&sz=5&hl=en&start=6&um=1&itbs=1&tbnid=UVhDEsi8cGirnM:&tbnh=96&tbnw=96&prev=/images?q=mahindra+%26+Mahindra&um=1&hl=en&sa=N&tbs=isch:1 -

8/8/2019 KSKEV Corpo Presentation

16/21

Corporate Presentation, 2010

Key Financials KSK Energy Ventures Limited ( Consolidated)

2,458

3,809

5,025

0

1,000

2,000

3,000

4,0005,000

6,000

FY08 FY09 FY10

InrMn

Revenues

2,158

3,3053,695

0

1,000

2,000

3,000

4,000

FY08 FY09 FY10

InrMn

EBITDA

1,086

1,454

1,913

0

500

1,000

1,500

2,000

2,500

FY08 FY09 FY10

InrMn

PAT957

1,001

862

9053.54

3.88

0

0.75

1.5

2.25

3

3.75

4.5

0

200

400

600

800

1,000

FY09 FY10

AvgTariff

MnUnits

Generation and Tariff (Rs /kwh)

MU - Generated MU - Sold Avg Tariff

-

8/8/2019 KSKEV Corpo Presentation

17/21

Corporate Presentation, 2010

Financials and Shareholding pattern KSKEV

Promoters

51%

ForeignCorporate

Bodies

22%

FIIs

15%

MFs

4%Body Corporates

3%

Banks

3%

Others2%

Shareholding Pattern

16

Balance Sheet - Consolidated Inr Mn

FY08 FY09 FY10

Sources of Funds

Share Capital 2,942 3,461 3,726

Reserves & Capital 3,428 16,360 22,894

Minority Interest 1,065 1,650 1,947

Debt 12,522 22,386 53,390

Deferred Tax Liability 39 60 123

Total 19,996 43,917 82,080Application of Funds

Fixed Assets (inclusive ofCWIP & Goodwill) 16,319 32,574 68,983

Investment 849 758 32

NCA 2,827 10,585 13,065

Total 19,996 43,917 82,080

Profit & Loss Statement - Consolidated Inr Mn

FY08 FY09 FY10

Revenue 2,458 3,809 5,025

EBITDA 2,158 3,305 3,695

Interest Expense 627 1,221 1,246

PBT 1,307 1,897 2,189

PAT 1,086 1,454 1,913

-

8/8/2019 KSKEV Corpo Presentation

18/21

Corporate Presentation, 2010

Overview Performance

KSK Response

Shortages of Fuel supplies and increasing

costs Challenges of Land acquisitions Support Infrastructure limitations and

challenges

Shortage of domestic power equipmentNew government regulations on overseas

contractors and visas

Global Financial crisis and shortages in

availability of capital Lag in capacity additions and shortages

Shortages and environmental issues more

pronounced Sponsor Equity Limited local rupee debt financing and local

sub contractors early movers to zoom ahead

on execution

Large scale Coal Block tie-up withgovernment mining companies

On ground development expertise leveraged Fast track progress and on ground

collaboration with stakeholders

Chinese equipment sourced with Qualityconcerns addressed and mandatory usage

of local sub contractors

Equity raised and limited dependence onnew debt funds

PPA mix of long term and short term

Environmental concerns addressed and newinitiatives planned

2010 focus on Completion of thecommissioning assets, installed capacity to

grow up to 862 MW (5 fold in 12 months)

2010 & 11 - Continuous Progress on 3600 MWPower project in Chhattisgarh on construction

as well as associated support infrastructure

Efficient operations and surplus power salearrangements to actualize returns

Industry Factors

OutlookFY2008, 09 & 10 FY2011

-

8/8/2019 KSKEV Corpo Presentation

19/21

Corporate Presentation, 2010

Coal access scenarios Securing fuel

18

Coal Linkage

Coal India subsidiaries

No Ownership

No Control on cost

No Control on Quality

Shortfalls in Guaranteed

quantities

Regular Linkage Cost Plus Blocks

Regular Tapering Regular Tapering

No Ownership

Dip side economics

Quality based on

identified blocks

Captive Coal blocks

Smaller size Blocks

Single Joint

Private Applicants

Control on Quality and

costs

End use restriction

Power, cement, steel

Challenges of end use

project synchronization

Challenges of Joint

exploitation

Govt. Dispensation Coal blocks

Larger size Blocks

SMDC Utilities

Government Applicants

Control on Quality and

costs

No end use restriction

Collaborative format

-

8/8/2019 KSKEV Corpo Presentation

20/21

Corporate Presentation, 2010

Emerging Private Power Players Business Models

Independent Power

Developers with distinct Fuel

access strategies

Independently developed and

hence associated developer

upsides

Large capacity in single

location Greenfield to

brown field

Mix of long term supplies to

short term PPA for deficit

period upsides

Dedicated fuel sources

domestic / Overseas and

hence control on

quality, quantity

Model 4

Regulated fixed Return

Power Plants for Utilities

(IPP)

Practically no Upsides in

generation activity and

hence diversified to wider

Infrastructure businesses

such as Roads, Airports /EPC business

Model 1

Model 2

Existing Industrial Business in

other commodities intending to

leverage their captive business

for independent power play

Challenges of Transfer Pricing -

host business competitiveness

vis--vis independent power

foot print and commonality of

fuel sourcing

Potential upsides with current

Challenges on long term Fuel

Linkages

Limited on ground progress of

projects

Model 3

Large business conglomerates

setting up Ultra Mega Power

projects (UMPP)

Government role of developer

and acquisition of developed

projects. Upsides on fuel /

generation conceded in bid

prices

Benefit of Integrated play -

downstream distribution

businesses and off take

stability but regulatory

determination

Limited upsides based on

execution, operational

efficiency or innovative

sourcing

18

-

8/8/2019 KSKEV Corpo Presentation

21/21

Corporate Presentation, 2010

Thank you