4m_sip

description

Transcript of 4m_sip

7/17/2019 4m_sip

http://slidepdf.com/reader/full/4msip 1/1

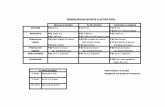

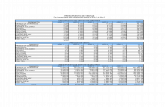

SUELDOBASE

COMPENSACIÓNGARANTIZADA

AYUDAPARA

DESPENSATOTAL

IMPUESTOSOBRE LA

RENTA

SEGURO DERETIRO,

CESANTÍA ENEDAD AVANZADA

Y VEJEZ

CUOTAS ALISSSTE TOTAL

M3C 15,359.43 81,145.12 365.00 96,869.55 26,339.88 940.77 691.17 27,971.82 68,897.73

M3B 12,502.21 67,453.21 365.00 80,320.42 20,773.43 765.76 562.60 22,101.79 58,218.63

M3A 12,502.21 54,318.97 365.00 67,186.18 16,570.47 765.76 562.60 17,898.83 49,287.35

M2C 10,813.81 68,484.90 365.00 79,663.71 20,563.28 662.35 486.62 21,712.25 57,951.46

M2B 10,813.81 56,007.37 365.00 67,186.18 16,570.47 662.35 486.62 17,719.44 49,466.74

M2A 10,813.81 46,465.41 365.00 57,644.22 13,614.16 662.35 486.62 14,763.13 42,881.09

M1C 9 ,107.13 57,714.05 365.00 67,186.18 16,570.47 557.81 409.82 17,538.10 49,648.08

M1B 9 ,107.13 48,172.08 365.00 57,644.21 13,614.16 557.81 409.82 14,581.79 43,062.42

M1A 9,107.13 40,016.56 365.00 49,488.69 11,167.51 557.81 409.82 12,135.14 37,353.55

N3C 9 ,107.13 39,933.80 365.00 49,405.93 11,142.68 557.81 409.82 12,110.31 37,295.62

N3B 9 ,107.13 31,951.97 365.00 41,424.10 8,748.13 557.81 409.82 9,715.76 31,708.34

N3A 9 ,107.13 25,579.94 365.00 35,052.07 6,836.52 557.81 409.82 7,804.15 27,247.92

N2C 8 ,907.05 31,816.68 365.00 41,088.73 8,647.52 545.56 400.82 9,593.90 31,494.83

N2B 8 ,907.05 25,780.01 365.00 35,052.06 6,836.52 545.56 400.82 7,782.90 27,269.16

N2A 8 ,907.05 20,907.10 365.00 30,179.15 5,540.38 545.56 400.82 6,486.76 23,692.39

N1C 8 ,616.09 25,354.37 365.00 34,335.46 6,621.54 527.74 387.72 7,537.00 26,798.46

N1B 8 ,616.09 21,198.07 365.00 30,179.16 5,540.38 527.74 387.72 6,455.84 23,723.32

N1A 8 ,616.09 17,788.67 365.00 26,769.76 4,738.49 527.74 387.72 5,653.95 21,115.81

O3C 8 ,335.77 21,604.66 365.00 30,305.43 5,570.08 510.57 375.11 6,455.76 23,849.67

O3B 8 ,335.77 18,068.99 365.00 26,769.76 4,738.49 510.57 375.11 5,624.17 21,145.59

O3A 8,335.77 14,967.53 365.00 23,668.30 4,009.03 510.57 375.11 4,894.71 18,773.59

O2C 8 ,065.70 18,339.06 365.00 26,769.76 4,738.49 494.02 362.96 5,595.47 21,174.29

O2B 8 ,065.70 15,237.60 365.00 23,668.30 4,009.03 494.02 362.96 4,866.01 18,802.29

O2A 8,065.70 12,517.02 365.00 20,947.72 3,369.15 494.02 362.96 4,226.13 16,721.59

O1C 7 ,805.50 15,497.80 365.00 23,668.30 4,009.03 478.09 351.25 4,838.37 18,829.93

O1B 7 ,805.50 12,777.22 365.00 20,947.72 3,369.15 478.09 351.25 4,198.49 16,749.23

O1A 7,805.50 10,390.75 365.00 18,561.25 2,855.56 478.09 351.25 3,684.90 14,876.35

VIGENCIA: ACTUALIZACIÓN01 DE ENERO DE 2015 D.O.F. 19/12/2014

INSTITUTO NACIONAL DE ESTAD STICA Y GEOGRAF A

TABULADOR DE PERCEPCIONES BRUTAS MENSUALES PARA LOS SERVIDORES PÚBLICOS CONSIDERADOS COMO:

PERSONAL DE MANDO (Eventual)DEL EJERCICIO FISCAL 2015

NIVEL

PERCEPCIONES DEDUCCIONES

INGRESONETO